My favorite lessons from Memos from the Chairman by Alan C. Greenberg. Which is a treasure trove of advice on frugality, avoiding complacency, and the dangers of overconfidence.

Five of my favorite ideas and stories on frugality and common sense from Alan C. Greenberg:

- Who is Alan C. Greenberg? And why study him?

- #1: Eliminate expenses ruthlessly and continually. No cost is too small—including paperclips and envelopes.

- #2: You have to fight complacency. Especially when you’re winning and it’s easy for it to hide in plain sight.

- #3: Never underinvest in strategic expenses, like hiring great people. Especially when others are laying them off.

- #4: Always be skeptical of convention wisdom. Play your own game and use common sense.

- #5: Whatever you achieved yesterday doesn’t matter today. Every day, the score resets to nothing to nothing.

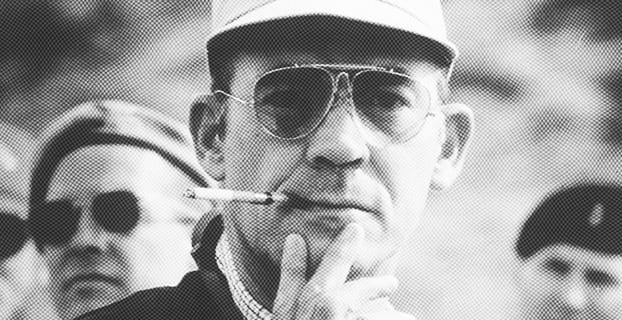

Who is Alan C. Greenberg? And why study him?

Alan C. Greenberg led Bear Stearns as CEO from 1978 to 1993 while it thrived as one of Wall Street’s fastest growing and most profitable investment banks. During that time, his favorite communication method was the written memos. He send hundreds to executives, partners, and all employees at Bear Stearns. And his memories are a thing of a legends.

Alan Greenberg's Memos from the Chairman are a goldmine of timeless advice around frugality, going against the grain, listening to common sense, and so much more. They're also hilarious, witty, and so much fun to read.

Here’s what Warren Buffett had to say about Alan C. Greenberg and his famous memos:

Ace Greenberg does almost everything better than I do—bridge, magic tricks, dog training, arbitrage—all the important things in life. He so excels at these that you might think it would give deep inferiority complexes to his colleagues. But if you think that, you don't know much about his colleagues.

In this book we finally learn where all this wit and wisdom—and there's plenty of both—come from: Haimchinkel Malintz Anaynikal. (I used to have trouble pronouncing his last name until I learned that the trick is to rhyme it with Ahaynikal.) Haimchinkel sees all, knows all, and tells all—but only through Ace, his Designated Oracle here on earth.

Haimchinkel is my kind of guy—cheap, smart, opinionated. I just wish I'd met him earlier in life, when, in the foolishness of youth, I used to discard paper clips. But it's never too late, and I now slavishly follow and preach his principles.

Many years ago, Where Are the Customers' Yachts?, through a humorous look at Wall Street, dispensed some of the best investment advice ever written. In this book, Ace has applied the same treatment to managerial advice with equal success.

WARREN BUFFETT

One of my favorite features of the memos is the frequent appearance of a character named Haimchinkel Malintz Anaynikal. Haimchinkel was a made up character that spoke through Alan C. Greenberg and acted as a sort of timeless business coach. As you’ll see, they feature frequently in most of the memos.

My favorite lessons from Memos from the Chairman by Alan C. Greenberg.

#1: Eliminate expenses ruthlessly and continually. No cost is too small—including paperclips and envelopes.

Like John D. Rockefeller, who constantly eliminated small costs while he built Standard Oil into a company that would be valued at $1 trillion today. Alan C. Greenberg always keeps part of the company’s focus on eliminating expenses. Especially the smallest, stupidest, and silliest of costs.

Throughout history the equation for bottom-line profits hasn’t changed. It’s always been revenue minus expenses. It pays to focus as much as removing expenses as on increasing revenue. You can’t control revenue, but you’re always in control of what you spend and what you spend it on.

#2: You have to fight complacency. Especially when you’re winning and it’s easy for it to hide in plain sight.

Like a winning coach one of Alan C. Greenberg’s constant refrains was to be on the lookout for complacency—especially when times are good. The best time to get lean, improve efficiency, and and eliminate waste is when times are good.

Memo: From the Desk of Alan C. Greenberg

Date: July 13, 1987

To: All Managing Directors

Subject: COST CONTROL AND OVERALL EFFICIENCY

Bear Stearns has recently announced a record year—a period during which some of the majors in our industry had problems in certain areas that affected adversely their P&L. We may be entitled to some degree of pride in our performance, but certainly not smug self-satisfaction.

While our cost/revenue ratios appear to be reasonably satisfactory, now is the time to pause and remind ourselves that:

• We have expanded rapidly, adding 800 employees during FY 1987 alone;

• The move to 245 Park Avenue will increase significantly our fixed expenses;

• Our industry is cyclical, and we are in the midst of the longest bull market in history;

• A sharp downturn could be painful if we are not lean and mean;

• Many of us get paid primarily out of bonus pool profits; and,

• Inevitably fat creeps in with expansion and prosperity.

Consequently, we want all Managing Directors to begin critically examining their areas. Here is a list of some of the things you should be reviewing:

A. Your work force

Who is not sufficiently productive?

Who should be replaced?

Who should be eliminated and need not be replaced?

Before hiring anyone new, ask whether your existing staff can be assigned additional responsibilities.

Do you have employees performing functions that are duplicating those performed in other departments, such as Accounting or Data Processing?

B. Other items to watch and do that will keep us neat & clean.

Are you paying for unused or uneconomic news or quotation services?

Are you paying outside vendors for services or material that are not really needed, or duplicate what is already available in-house?

Do you have too many telephones and underutilized fixed wires?

Are you controlling such things as Federal Express, messenger services, and personal long-distance calls?

Do you & your associates reread daily my major memos on rubber bands, paper clips and envelope recycling? I feel that adhering to those memos was the main reason last year was a success.

Bear Stearns has grown and prospered because capable, aggressive, money-motivated people worked hard, were given substantial responsibility, and watched their businesses and each other. The biggest challenge is yet to come—start getting ready NOW.

If you don’t do it—we will have to do it for you and that will be less pleasant and less efficient. This place is not going to smell like a bureaucracy—bureaucracies don’t set records. We own 60% of this place—let’s keep it sound and make it grow. Our compensation is based on the firm’s profitability. In addition, I am newly married, and I am in no mood to take a pay cut. Regardless of what your experience has been, I am finding that two cannot live as cheaply as one.

As Alan says, “Inevitably fat creeps in with expansion and prosperity.” Your job is to fight that fat constantly.

#3: Never underinvest in strategic expenses, like hiring great people. Especially when others are laying them off.

Part of the power in ruthlessly rooting out costs and expenses is that it forces you to think ruthlessly about what expenses are strategic and which are non-strategic. Non-strategic expenses, like office supplies, should be rooted out ruthlessly.

But strategic expenses, like hiring great people, should never be eliminated. You should invest in them continually—outspending your competitors in good times and bad times.

Memo: From the Desk of Alan C. Greenberg

Date: July 25, 1984

To: All General & Limited Partners

The newspapers are full of the quarterly financial results of the publicly owned investment banking firms. For the three months ended June 30th, Bear, Stearns & Co. had a loss of $3,473,000, after interest on partners’ capital.

That figure will not help you buy much from Tiffany, but it does mean that we are keeping things under reasonable control. Keep in mind that the figures of our corporate competitors are usually after tax credits. For example, the loss of $33 million by Merrill, Lynch, reported this morning, was really $90 million before tax credits.

We are not panicking; we are not laying off people, but we are making a real effort to cut expenses. The other side of the coin is we have hired a large number of number one draft picks in the last few months. This is the time to hire good people. We have followed this policy in the past, and I am convinced that we will be proven correct once again.

I did not want to write this memo, but Haimchinkel Malintz Anaynikal insisted that I communicate with the troops, even when the news is less than perfect. Haimchinkel Malintz Anaynikal also mentioned that now is the time not to hide from clients. It takes real courage to make calls when you know the reception might be hostile. But there are times when we must face the music. It will pay off when the market turns, and I promise you the market will turn. I hope sooner rather than later.

The best time to hire great people is when they’re being laid off by bloated, complacent, not cost-conscious firms.

#4: Always be skeptical of convention wisdom. Play your own game and use common sense.

Alan C. Greenberg had a healthy skepticism of convention wisdom. While his competitors hired MBAs, Bear Stearns hired PSDs (people who are poor, smart, and desperate to get rich). While others followed the popular management framework of the day, Bear Stearns just applied common sense and avoided stupidity.

Memo: From the Desk of Alan C. Greenberg

Date: September 24, 1993

To: All Managing & Associate Directors

During the last few months the business community has been exposed to some new management tools. They are known by the cognoscenti as Total Quality Management (TQM), Continuous Improvement (CI), Business Process Reengineering (BPR) and Other Trading and Organizational Development Initiatives (OTAODI). Your Executive Committee is always looking for ways to improve our performance, and those titles intrigued us.

We appointed a committee (C) consisting of Haimchinkel Malintz Anaynikal (HMA) and Itzhak Nanook Pumpernickanaylian (INP) to do a comprehensive study. We thought you might be interested in the results. From now on we will use the jargon of advanced management.

The "C" discovered that we have lost 90% of our competitors over the last 20 years.

Most of those managements were precocious; they were using those catchy techniques years ago.

35% used TQM

25% used CI

20% used BPR

10% used OTAODI

The remaining 10% did not use any sophisticated management tools, they were just extra special stupid.

The "C" suggested that we stick to common sense (CS) because catchy titles will never supplant "CS." If you disagree, you are working at the wrong place.

#5: Whatever you achieved yesterday doesn’t matter today. Every day, the score resets to nothing to nothing.

Finally, remember that every day the score resets and starts back at nothing to nothing. Whatever success you enjoyed yesterday, what feats you accomplished, are now backstory. Your focus always has to be on getting points onto the scoreboard today.

Memo: From the Desk of Alan C. Greenberg

Date: May 2, 1983

To: All General & Limited Partners

Haimchinkel Malintz Anaynikal just called and reminded me of something that I should have thought of without any help.

The year was over last Friday and it was a good one, but last year is gone. The score right now is nothing to nothing. Nobody cares (especially our competition) what we did last year.

Let us go to the whip and make the month of May an indication of what we are going to do for the coming twelve months.

Read the full book summary and buy the book.

All of these quotes and stories are from of Memos from the Chairman. Which is a goldmine of timeless advice around frugality, going against the grain, listening to common sense, and so much more.

Go deeper: Explore all of my highlights and notes from the book →

P.S. As a parting gift, I can’t help but share three other incredible memos from the book. Make sure to buy a copy of the book to read them all.

Memo: From the Desk of Alan C. Greenberg

Date: August 21, 1987

To: All Managing & Associate Directors

Bear Stearns is not having a hiring freeze.

Our experience has been that the best time to hire productive people is when conditions are difficult. Some areas of Wall Street are having problems and that means opportunity is once again knocking at our door. Let us all be alert and continue to build!

I would like to announce at this time a freeze on expenses and carelessness. We probably throw away millions every year with stupidities and slop. In fact, I have seen more slop in the last three weeks than in the previous six months. Stop it now. No business is strong enough to withstand constant stupidity.

Haimchinkel Malintz Anaynikal is really something. Just take a look at my June 13, 1987 memo and see once again how right he was. He hates slop, even more than I do. In fact, he pointed out to me where our stock could be if we ran a neat, tight shop. I am tired of cleaning up poo-poos. The next associate of mine that does something "un-neat" is going to have a little meeting with me and I will not be the usual charming, sweet, understanding, pleasant, entertaining, affable yokel from Oklahoma.

Always be on the look out for complacency. Cut costs, improve efficiency, and eliminate waste when times are great and you’re in a position of strength.

Memo: From the Desk of Alan C. Greenberg

Date: September 10, 1985

To: All General & Limited Partners

Subject: MEMO PADS

We have been supplying everyone with memo pads. These pads have, at the top, our logo and also a person’s name and telephone number. This is conceptually wrong. We are in a person-to-person business. It would be much warmer if the sender of a note signed it with his name and telephone number along with some sweet words, such as “I love you” or “I need more business to feed my family.”

Therefore, continuing our goal of trying to increase the income of our associates, pads from now on will only have Bear, Stearns & Co. printed across the top.

It is amazing how one good idea sometimes produces unforeseen benefits. Haimchinkel Malintz Anaynikal just informed me that this superior way of communicating will save us $45,000 a year. What a pleasant surprise!!

Memo: From the Desk of Alan C. Greenberg

Date: June 9, 1989

To: All Managing & Associate Directors

I had a dream. The dream was that I returned to this world as a seller of fax machines and I had Bear Stearns as an account.

We are ordering fax machines around here like they are being given away—and they are not!

We had a study done of fax machines and it has been proven conclusively that the machines do not object to different people using them. This means that it is possible for people and departments to share in the use of these inanimate objects.

Before you or your associates request another machine, please explore sharing or moving a machine we already own closer to your area.

This idea is a good one and I can say that because it was not mine. It came from Nookie's wife and sister-in-law. Common sense seems to flow in the veins of that group.