We break down the stocks David Tepper (Appaloosa) bought, sold, and held in Q1 2024, including their holdings at the end of the quarter. All data sourced from Appaloosa's 13F filed on May 15, 2024.

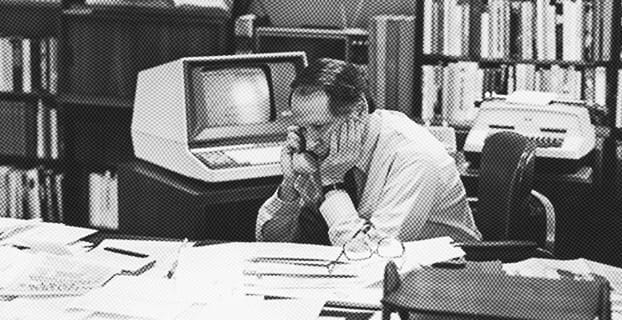

Who are David Tepper and Appaloosa?

Appaloosa Management is a hedge fund founded in 1993 by David Tepper, who gained fame for his bold contrarian bets during the 2008 financial crisis that yielded billions in profits. Originally specializing in distressed debt, the firm has evolved to invest flexibly across public equities and fixed income markets globally. Tepper's opportunistic investment approach combines macroeconomic analysis with deep fundamental research, allowing Appaloosa to identify mispriced assets during periods of market dislocation. The firm has delivered exceptional long-term returns, establishing Tepper as one of the most successful hedge fund managers of his generation.

AMLP.com

Wikipedia on David Tepper

Portfolio Changes in Q1 2024

New positions

Appaloosa initiated several significant new positions in Q1 2024, with the largest being Adobe (ADBE) at $176.6 million, followed by China-focused ETFs China Large Cap (FXI) at $153.4 million and China Internet (KWEB) at $91.2 million. The fund also established new stakes in JD.com (JD) worth $99.97 million, Boeing (BA) at $43.4 million, and Lyft (LYFT) at $9.0 million.

Bought

Appaloosa significantly increased its exposure to Chinese technology stocks, nearly tripling its Alibaba (BABA) position by adding 6.9 million shares to reach a $814 million stake. The fund also substantially boosted positions in PDD Holdings (PDD) by adding 1.3 million shares, Baidu (BIDU) by adding 1.2 million shares, and Oracle (ORCL) by adding 975,000 shares, demonstrating a strong conviction in Chinese tech and enterprise software.

Sold

Appaloosa made dramatic reductions to several major technology holdings, cutting its Microsoft (MSFT) position by 91% from $639 million to just $63 million, and reducing Uber (UBER) by 77% from $369 million to $105 million. The fund also completely exited ARK Innovation (ARKK) (worth $133.5 million), HCA Healthcare (HCA), and several other positions while trimming Meta (META) by $110 million and Macy's (M) by 69%.

New Investments in Q1 2024

| Ticker | Company | Weight | Change | Value |

|---|---|---|---|---|

| ADBE | Adobe | 30.8% | NEW | $176.61M |

| FXI | China Large Cap | 26.7% | NEW | $153.45M |

| JD | JD.com | 17.4% | NEW | $99.97M |

| KWEB | China Internet | 15.9% | NEW | $91.22M |

| BA | Boeing | 7.6% | NEW | $43.42M |

| LYFT | Lyft | 1.6% | NEW | $9.05M |

Adobe ADBE

David Tepper bought $176.61M of Adobe in Q1 2024. Adobe delivered record Q1 FY2025 results with $5.71B revenue (10% YoY growth), driven by AI innovation and strong demand across Creative Cloud, Document Cloud, and Experience Cloud. The company reaffirmed its FY2025 targets, highlighting $125M ending ARR from new AI-first products and $2.48B operating cash flow. Recent AI advancements and customer-focused strategy previews ahead of Adobe Summit position the company for sustained growth in digital experience markets.

- Q1 revenue grew 10% YoY to $5.71B with 11% constant currency growth.

- Non-GAAP EPS increased 13% YoY to $5.08, outpacing market expectations.

- New AI-driven products achieved $125M ending ARR within first quarter of availability.

China Large Cap FXI

David Tepper bought $153.45M of China Large Cap in Q1 2024. The iShares China Large-Cap ETF (FXI) surged 21% in Q1 2025, driven by gains in tech holdings like Alibaba (70% YTD) and Tencent (30% YTD), but has pulled back to a 17.81% YTD return as of May 2025 amid stagflation and trade war concerns. It has significantly outperformed the U.S. market, with the S&P 500 ETF (VOO) declining 4% YTD. Recent momentum reflects shifting investor focus to Chinese equities as alternatives to strained U.S. markets.

- 21% return in Q1 2025, contributing to most of its YTD performance.

- 30% outperformance against S&P 500 YTD as of May 2025.

- Top holding Alibaba gained 70% YTD through Q1 on AI-driven earnings growth.

JD.com JD

David Tepper bought $99.97M of JD.com in Q1 2024. JD.com demonstrated strong growth in Q1 2025 with 15.8% year-over-year revenue growth to RMB301.1 billion ($41.5B USD), driven by improved operational efficiency and strategic supply chain investments. The company's operating margin expanded to 3.5% (up 50bps YoY) with JD Retail's margin reaching 4.9%, while net income surged 52.7% to RMB10.9 billion ($1.5B USD). Recent margin expansion and accelerating growth across all business segments position JD.com for continued outperformance in China's competitive e-commerce sector.

- Q1 2025 EPS grew 58.7% to RMB7.19 from RMB4.53 YoY.

- Non-GAAP operating margin improved 50bps to 3.9% from 3.4% in Q1 2024.

- JD Retail segment operating margin expanded 80bps to 4.9% through supply chain optimizations.

China Internet KWEB

David Tepper bought $91.22M of China Internet in Q1 2024. KraneShares CSI China Internet ETF (KWEB) delivered strong performance in Q1 2025, returning +18.42% compared to the S&P 500's -4.28% decline, driven by AI innovation and earnings beats from top holdings. The ETF has gained 19.63% year-to-date through February 2025, with 65% of assets now held in Hong Kong-listed shares to mitigate ADR risk. Recent AI developments across portfolio companies position KWEB as a leader in China's internet sector transformation.

- 42.29% total return over last 12 months through February 2025.

- 8/10 top holdings beat Q4 2024 EPS estimates, signaling fundamental strength.

- 0.70% expense ratio remains competitive among China-focused ETFs.

Boeing BA

David Tepper bought $43.42M of Boeing in Q1 2024. Boeing (BA) showed marked improvement in Q1 2025 with 17.5% revenue growth to $19.5 billion and a return to positive operating margins (2.4% vs -0.5% YoY), signaling operational recovery. This follows a dismal Q4 2024 (-$5.90 EPS) and reflects progress in stabilizing production and delivery bottlenecks. Despite these gains, BA shares have underperformed peers (2.5% vs 3.4% industry return) over the past year as investors remain cautious about sustained execution.

- Revenue surged 17.5% YoY to $19.5B in Q1 2025, beating estimates.

- Operating cash flow improved 52% YoY (-$1.62B vs -$3.36B).

- Shares gained 2.5% over past year vs 8.2% S&P 500 return.

Lyft LYFT

David Tepper bought $9.05M of Lyft in Q1 2024. Lyft reported its strongest Q1 performance in 2025 with 16% rides growth and 13% YoY Gross Bookings increase, marking its 16th consecutive quarter of double-digit growth. Strategic expansions into Europe via the FREENOW acquisition and targeting new demographics with Lyft Silver have strengthened its market position. The company demonstrated robust financial health with nearly $1 billion in trailing twelve-month cash flow and increased its share repurchase program to $750 million, driving a 7.69% aftermarket stock surge despite missing EPS and revenue forecasts.

- Q1 2025 Gross Bookings grew 13% YoY to $4.2 billion.

- Stock price surged 7.69% post-earnings amid optimism over growth initiatives.

- Share repurchase authorization increased to $750 million, reflecting strong cash generation.

Holdings at the end of Q1 2024

| Ticker | Company | Weight | Change | Value |

|---|---|---|---|---|

| BABA | Alibaba | 13.2% | Added (+159%) | $814.05M |

| AMZN | Amazon | 11.2% | Trimmed (-3%) | $690.49M |

| META | Meta | 8.8% | Trimmed (-39%) | $545.06M |

| NVDA | Nvidia | 6.5% | Trimmed (-44%) | $399.37M |

| GOOG | Alphabet | 5.1% | Trimmed (-10%) | $315.94M |

| AMD | AMD | 4.8% | Trimmed (-19%) | $294.2M |

| ORCL | Oracle | 4.7% | Added (+74%) | $288.9M |

| PDD | PDD Holdings | 4.0% | Added (+171%) | $244.12M |

| BIDU | Baidu | 3.1% | Added (+188%) | $189.5M |

| ADBE | Adobe | 2.9% | NEW | $176.61M |

| FDX | FedEx | 2.8% | Trimmed (-8%) | $173.84M |

| QCOM | Qualcomm | 2.7% | Trimmed (-1%) | $167.61M |

| INTC | Intel | 2.7% | Trimmed (-18%) | $165.64M |

| FXI | China Large Cap | 2.5% | NEW | $153.45M |

| MU | Micron | 2.3% | $143.24M | |

| ET | Energy Transfer | 2.2% | Trimmed (-12%) | $135.98M |

| LRCX | Lam Research | 1.8% | Trimmed (-3%) | $111.73M |

| UBER | Uber | 1.7% | Trimmed (-77%) | $104.71M |

| CZR | Caesars Entertainment | 1.6% | Added (+2%) | $100.6M |

| JD | JD.com | 1.6% | NEW | $99.97M |

| UNH | UnitedHealth | 1.6% | $98.94M | |

| KWEB | China Internet | 1.5% | NEW | $91.22M |

| UPS | UPS | 1.4% | Added (+20%) | $89.18M |

| ASML | ASML | 1.3% | $77.64M | |

| EQT | EQT | 1.2% | $76.36M | |

| TSM | Taiwan Semiconductor | 1.1% | $68.03M | |

| MSFT | Microsoft | 1.0% | Trimmed (-91%) | $63.11M |

| AR | Antero Resources | 0.9% | $58M | |

| BA | Boeing | 0.7% | NEW | $43.42M |

| SWN | Southwestern Energy | 0.6% | $36.38M | |

| M | Macy's | 0.5% | Trimmed (-69%) | $27.99M |

| MPLX | MPLX | 0.4% | $27.43M | |

| BEKE | KE Holdings | 0.4% | $23.41M | |

| CHKEZ | Chesapeake Energy | 0.3% | $20.35M | |

| CHK | Chesapeake Energy | 0.3% | $18.03M | |

| NSC | Norfolk Southern | 0.2% | $11.47M | |

| CHKEL | Chesapeake Energy | 0.2% | $10.8M | |

| LYFT | Lyft | 0.1% | NEW | $9.05M |

| ARKK | ARK Innovation | 0.0% | Exited | $0 |

| HCA | HCA Healthcare | 0.0% | Exited | $0 |

| FMC | FMC | 0.0% | Exited | $0 |

| WHR | Whirlpool | 0.0% | Exited | $0 |

| MHK | Mohawk | 0.0% | Exited | $0 |

| GM | General Motors | 0.0% | Exited | $0 |

| MAS | Masco | 0.0% | Exited | $0 |

| OC | Owens Corning | 0.0% | Exited | $0 |

Disclaimer: All posts on Scout are for informational purposes only. They are NOT a recommendation to buy or sell the securities discussed. Please do your own research and due diligence before investing your money.