We break down the stocks David Tepper (Appaloosa) bought, sold, and held in Q2 2024, including their holdings at the end of the quarter. All data sourced from Appaloosa's 13F filed on August 14, 2024.

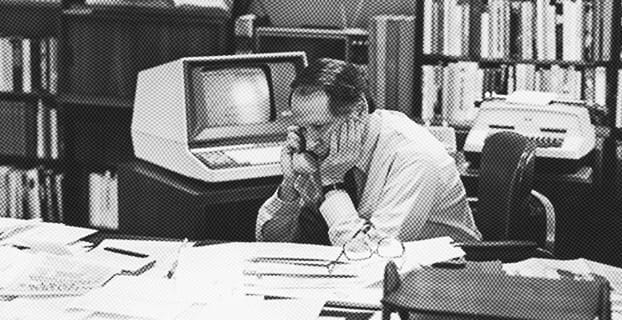

Who are David Tepper and Appaloosa?

Appaloosa Management is a hedge fund founded in 1993 by David Tepper, who gained fame for his bold contrarian bets during the 2008 financial crisis that yielded billions in profits. Originally specializing in distressed debt, the firm has evolved to invest flexibly across public equities and fixed income markets globally. Tepper's opportunistic investment approach combines macroeconomic analysis with deep fundamental research, allowing Appaloosa to identify mispriced assets during periods of market dislocation. The firm has delivered exceptional long-term returns, establishing Tepper as one of the most successful hedge fund managers of his generation.

AMLP.com

Wikipedia on David Tepper

Portfolio Changes in Q2 2024

New positions

Appaloosa did not initiate any new positions during Q2 2024.

Bought

Appaloosa made significant additions to several existing positions, most notably dramatically increasing their stake in Lyft (LYFT) by over 7.4 million shares and Microsoft (MSFT) by over 1 million shares. The firm also added substantially to Chinese holdings including China Internet (KWEB) with over 1 million additional shares, JD.com (JD), China Large Cap (FXI), and KE Holdings (BEKE). Additionally, they increased their position in Nvidia (NVDA) by 248,000 shares.

Sold

Appaloosa completely liquidated their 45,000-share position in Norfolk Southern (NSC) worth $11.5 million. The firm also trimmed several major technology and energy holdings, reducing their positions in Intel (INTC) by 970,000 shares, Energy Transfer (ET) by 940,000 shares, and Alibaba (BABA) by 750,000 shares. Other notable reductions included Amazon (AMZN), Oracle (ORCL), AMD (AMD), Meta (META), and various energy positions including Southwestern Energy (SWN) and EQT (EQT).

Holdings at the end of Q2 2024

| Ticker | Company | Weight | Change | Value |

|---|---|---|---|---|

| BABA | Alibaba | 17.2% | Trimmed (-7%) | $756M |

| AMZN | Amazon | 15.3% | Trimmed (-9%) | $671.54M |

| MSFT | Microsoft | 12.0% | Added (+688%) | $528.01M |

| META | Meta | 10.7% | Trimmed (-17%) | $471.45M |

| ORCL | Oracle | 6.4% | Trimmed (-13%) | $282.4M |

| PDD | PDD Holdings | 5.9% | Trimmed (-8%) | $257.92M |

| AMD | AMD | 5.1% | Trimmed (-16%) | $222.23M |

| FXI | China Large Cap | 4.1% | Added (+9%) | $180.37M |

| QCOM | Qualcomm | 3.8% | Trimmed (-15%) | $167.31M |

| ET | Energy Transfer | 2.8% | Trimmed (-11%) | $124.97M |

| KWEB | China Internet | 2.8% | Added (+29%) | $121.32M |

| LYFT | Lyft | 2.6% | Added (+1603%) | $112.25M |

| JD | JD.com | 2.5% | Added (+18%) | $111.39M |

| INTC | Intel | 2.0% | Trimmed (-26%) | $86.1M |

| NVDA | Nvidia | 1.9% | Added (+56%) | $85.24M |

| EQT | EQT | 1.6% | Trimmed (-8%) | $70.45M |

| AR | Antero Resources | 1.4% | Trimmed (-8%) | $60.37M |

| SWN | Southwestern Energy | 0.7% | Trimmed (-8%) | $29.88M |

| BEKE | KE Holdings | 0.7% | Added (+22%) | $29.5M |

| CHKEZ | Chesapeake Energy | 0.4% | $17.89M | |

| CHKEL | Chesapeake Energy | 0.2% | $9.3M | |

| NSC | Norfolk Southern | 0.0% | Exited | $0 |

Disclaimer: All posts on Scout are for informational purposes only. They are NOT a recommendation to buy or sell the securities discussed. Please do your own research and due diligence before investing your money.