We break down the stocks David Tepper (Appaloosa) bought, sold, and held in Q3 2024, including their holdings at the end of the quarter. All data sourced from Appaloosa's 13F filed on November 14, 2024.

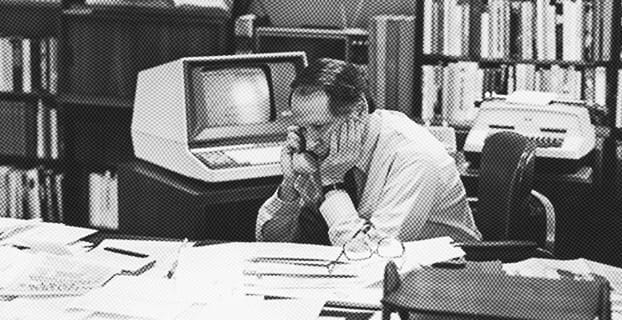

Who are David Tepper and Appaloosa?

Appaloosa Management is a hedge fund founded in 1993 by David Tepper, who gained fame for his bold contrarian bets during the 2008 financial crisis that yielded billions in profits. Originally specializing in distressed debt, the firm has evolved to invest flexibly across public equities and fixed income markets globally. Tepper's opportunistic investment approach combines macroeconomic analysis with deep fundamental research, allowing Appaloosa to identify mispriced assets during periods of market dislocation. The firm has delivered exceptional long-term returns, establishing Tepper as one of the most successful hedge fund managers of his generation.

AMLP.com

Wikipedia on David Tepper

Portfolio Changes in Q3 2024

New positions

Appaloosa initiated four new positions totaling approximately $395 million, with a strong focus on energy and gaming sectors. The firm established its largest new position in Vistra (VST) worth $150.6 million, followed by NRG Energy (NRG) at $91.1 million, indicating a significant bet on the power generation sector. The firm also entered the gaming space with substantial positions in Las Vegas Sands (LVS) at $76.9 million and Wynn Resorts (WYNN) at $76.7 million.

Bought

Appaloosa significantly increased its exposure to Chinese technology stocks, nearly doubling its position in Lyft (LYFT) from 7.96 million to 15.75 million shares. The firm more than doubled its holdings in PDD Holdings (PDD) from 1.94 million to 5.30 million shares, and substantially increased its JD.com (JD) position from 4.31 million to 7.30 million shares, demonstrating strong conviction in Chinese e-commerce despite ongoing market uncertainties.

Sold

Appaloosa completely exited three positions, liquidating UPS (UPS) for $82.8 million, Boeing (BA) for $38.2 million, and Macy's (M) for $24.3 million. The firm also trimmed numerous technology holdings, reducing positions in major names including Meta (META), Amazon (AMZN), Microsoft (MSFT), Intel (INTC), AMD (AMD), and Adobe (ADBE), while also paring back some Chinese positions including Alibaba (BABA) and energy holdings like Energy Transfer (ET).

New Investments in Q3 2024

| Ticker | Company | Weight | Change | Value |

|---|---|---|---|---|

| VST | Vistra | 38.1% | NEW | $150.59M |

| NRG | NRG Energy | 23.0% | NEW | $91.08M |

| LVS | Las Vegas Sands | 19.5% | NEW | $76.94M |

| WYNN | Wynn Resorts | 19.4% | NEW | $76.7M |

Vistra VST

David Tepper bought $150.59M of Vistra in Q3 2024. Vistra (VST) reported mixed Q1 2025 results with 28.8% revenue growth to $3.93 billion driven by its retail segment, but swung to a net loss of $268 million from $18 million net income in Q1 2024. The company reaffirmed its 2025 guidance midpoint of $5.8 billion EBITDA and accelerated share repurchases, buying back 30% of shares since 2021. While operational performance remains strong with 95% plant availability, rising operating costs (+39.2% YoY) and interest expenses (+87.6% YoY) pressured margins.

- Q1 revenue beat rose 28.8% YoY to $3.93B though missed estimates by 10.7%.

- Net loss swung $286M YoY (Q1 2025: -$268M vs Q1 2024: +$18M).

- $5.2B shares repurchased since 2021 with $1.5B remaining authorization through 2026.

NRG Energy NRG

David Tepper bought $91.08M of NRG Energy in Q3 2024. NRG Energy delivered exceptional Q1 2025 results, with adjusted EPS of $2.68 (84% YoY growth) and revenue of $8.59B, significantly surpassing estimates. Strategic acquisitions and operational efficiency drove a 30% EBITDA increase to $1.1B, while the stock surged 21% post-earnings. The company strengthened its competitive position in energy markets and reaffirmed its 2025 guidance with raised long-term growth targets.

- Adjusted EPS surged 84% year-over-year to $2.68, beating estimates by $1.01.

- Q1 revenue reached $8.59 billion, exceeding forecasts by nearly $1 billion.

- Stock price jumped 21.08% post-announcement, with trailing EBITDA now at $3.49B.

Las Vegas Sands LVS

David Tepper bought $76.94M of Las Vegas Sands in Q3 2024. Las Vegas Sands reported mixed Q1 2025 results with $2.86B revenue (-3.3% YoY) and $408M net income (-30% YoY), slightly missing EPS estimates by $0.01. While Marina Bay Sands achieved record EBITDA, Macau operations faced headwinds from non-rolling table revenue declines (-18% QoQ) and increased labor costs. The company is investing in smart table technology and non-gaming amenities to drive future growth amid valuation pressures.

- Q1 2025 EPS of $0.49 represents 25.8% decline from $0.66 YoY.

- Gross margin improved to 39.8% in Q1 from 38.0% in Q4 2024 despite revenue dip.

- Stock gained 0.35% post-earnings as investors responded to $1B share repurchase authorization.

Wynn Resorts WYNN

David Tepper bought $76.7M of Wynn Resorts in Q3 2024. Wynn Resorts (WYNN) reported mixed Q1 2025 results with revenues of $1.7 billion (down 8.7% YoY) and EPS of $1.07, missing estimates by 12.3%. While Macau operations showed strong recovery with a 31% YoY turnover increase, overall performance was impacted by reduced Las Vegas activity post-Super Bowl 2024 and tariff-related economic uncertainties. The company maintains financial resilience with $3.2 billion liquidity and repurchased 2.36 million shares in Q1.

- Q1 2025 revenue declined $162.5 million (-8.7%) YoY to $1.7 billion, missing estimates by 1.5%.

- Macau operations grew 31% YoY, offsetting part of Las Vegas' post-Super Bowl normalization.

- Repurchased 2.36 million shares (1.4% float) in Q1 while maintaining 4.3x net leverage ratio.

Holdings at the end of Q3 2024

| Ticker | Company | Weight | Change | Value |

|---|---|---|---|---|

| BABA | Alibaba | 18.9% | Trimmed (-5%) | $1.06B |

| PDD | PDD Holdings | 12.7% | Added (+173%) | $714.65M |

| AMZN | Amazon | 10.6% | Trimmed (-8%) | $596.26M |

| MSFT | Microsoft | 7.4% | Trimmed (-18%) | $417.39M |

| META | Meta | 6.4% | Trimmed (-33%) | $357.77M |

| JD | JD.com | 5.2% | Added (+69%) | $292M |

| ORCL | Oracle | 4.8% | Trimmed (-21%) | $268.11M |

| LYFT | Lyft | 3.6% | Added (+98%) | $200.81M |

| AMD | AMD | 3.3% | Trimmed (-17%) | $186.23M |

| FXI | China Large Cap | 3.3% | Trimmed (-16%) | $185.44M |

| VST | Vistra | 2.7% | NEW | $150.59M |

| BIDU | Baidu | 2.7% | Trimmed (-14%) | $150.04M |

| KWEB | China Internet | 2.3% | Trimmed (-16%) | $128.09M |

| ET | Energy Transfer | 2.0% | Trimmed (-11%) | $109.59M |

| MU | Micron | 1.9% | Trimmed (-11%) | $108.9M |

| ADBE | Adobe | 1.8% | Trimmed (-44%) | $103.56M |

| FDX | FedEx | 1.8% | Trimmed (-32%) | $102.63M |

| NRG | NRG Energy | 1.6% | NEW | $91.08M |

| LVS | Las Vegas Sands | 1.4% | NEW | $76.94M |

| WYNN | Wynn Resorts | 1.4% | NEW | $76.7M |

| EQT | EQT | 1.2% | Trimmed (-6%) | $65.77M |

| INTC | Intel | 1.0% | Trimmed (-10%) | $58.65M |

| AR | Antero Resources | 0.9% | Trimmed (-6%) | $49.99M |

| SWN | Southwestern Energy | 0.5% | Trimmed (-6%) | $29.72M |

| CHKEZ | Chesapeake Energy | 0.3% | $17.4M | |

| CHKEL | Chesapeake Energy | 0.2% | $9.86M | |

| UPS | UPS | 0.0% | Exited | $0 |

| BA | Boeing | 0.0% | Exited | $0 |

| M | Macy's | 0.0% | Exited | $0 |

Disclaimer: All posts on Scout are for informational purposes only. They are NOT a recommendation to buy or sell the securities discussed. Please do your own research and due diligence before investing your money.